Who We Are

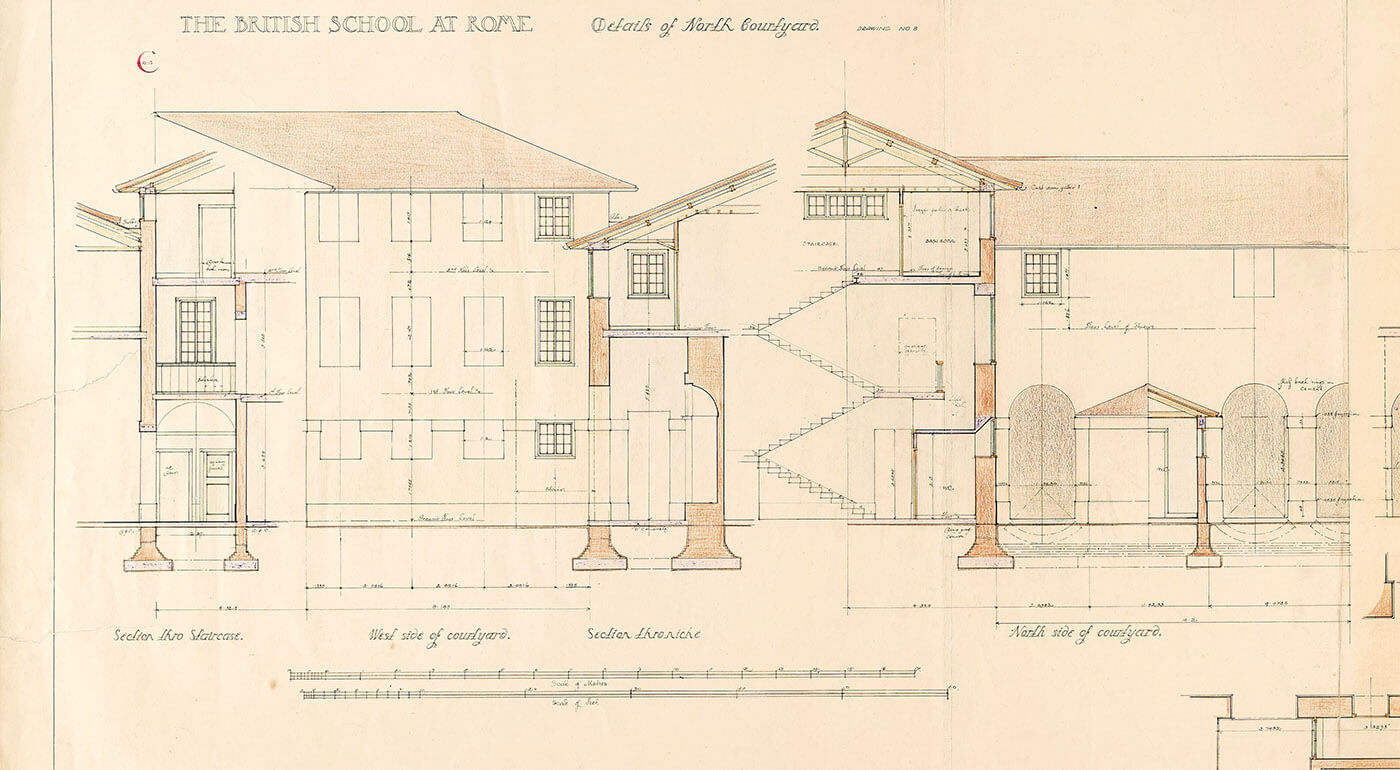

For 100 years, world-class researchers and contemporary artists have been nurtured at the British School at Rome. We are the bridge between the intellectual and cultural heart of Rome and Italy, and creative and academic researchers from the United Kingdom of Great Britain and Northern Ireland and the Commonwealth. We welcome people from a wide range of backgrounds to a stimulating environment of interdisciplinary research and practice where work of the very highest quality is generated and facilitated in a transformative intellectual context.

Who We Are

For 100 years, world-class researchers and contemporary artists have been nurtured at the British School at Rome. We are the bridge between the intellectual and cultural heart of Rome and Italy, and creative and academic researchers from the United Kingdom of Great Britain and Northern Ireland and the Commonwealth. We welcome people from a wide range of backgrounds to a stimulating environment of interdisciplinary research and practice where work of the very highest quality is generated and facilitated in a transformative intellectual context.

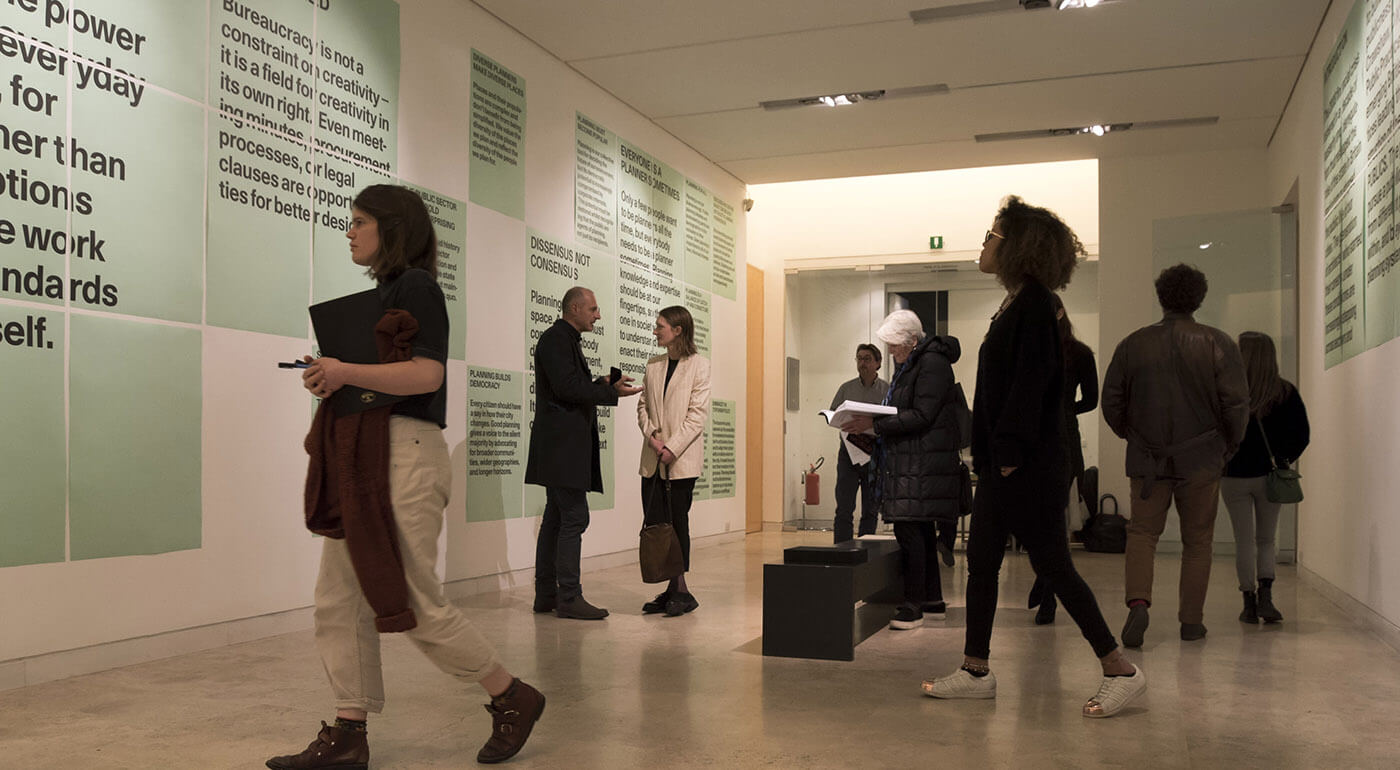

What We Do

What We Do

What's On

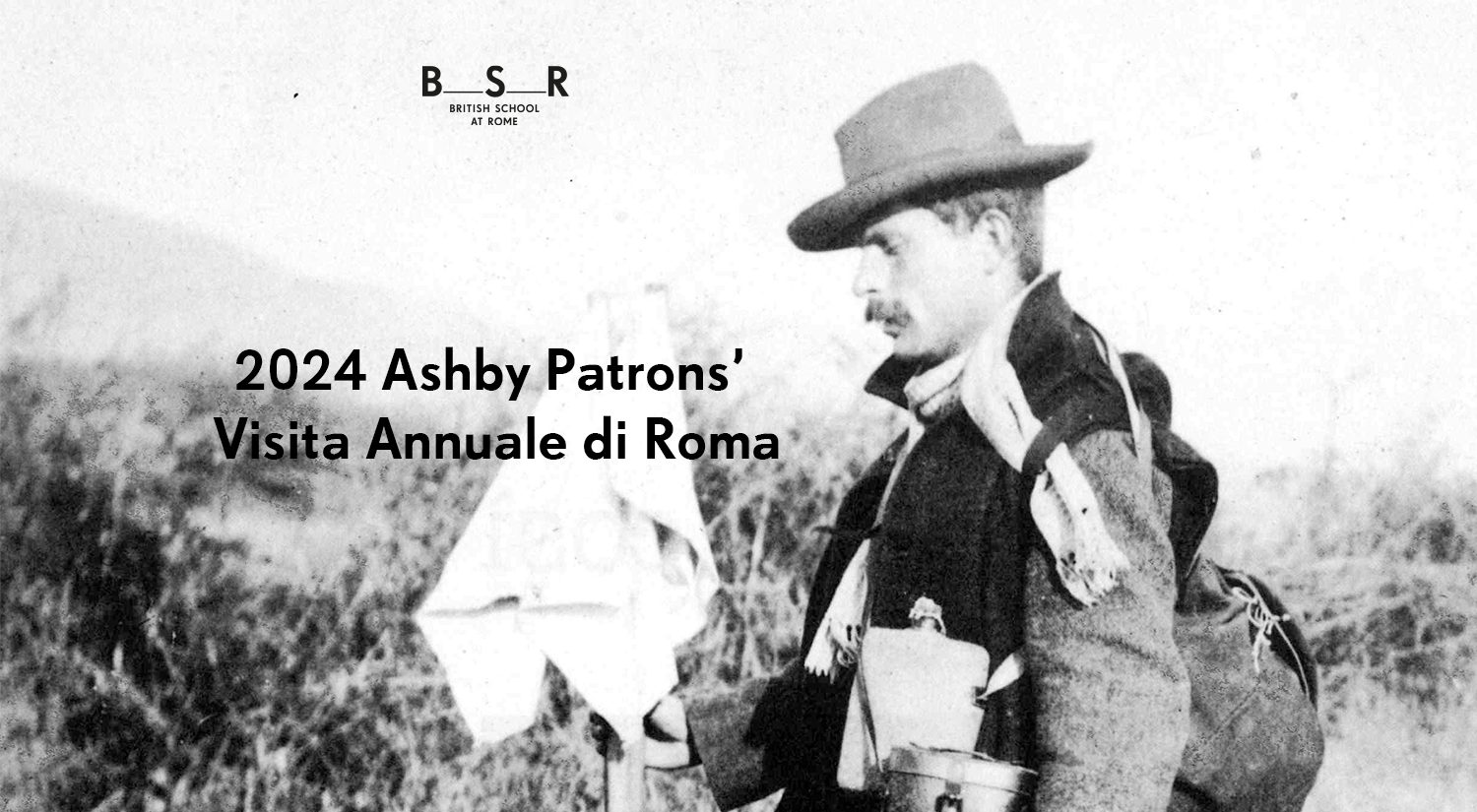

Further itinerary details in the coming months. If you are an Ashby Patron please add these dates to your diary and stay tuned! If you

18 - 21 April 2024

This lecture will be in English. The contribution illustrates the projects and new challenges of the Appia Antica Archaeological Park, an independent Institute of the Italian

24 April 2024

18:00 - 19:30

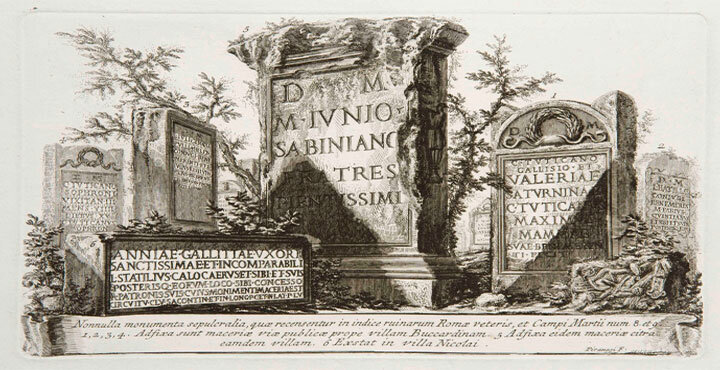

This lecture will be in Italian. Filippo Coarelli è nato a Roma il 9 Giugno 1936. Ha insegnato nelle Università di Roma, Siena, Cosenza, Perugia.

2 May 2024

18:00 - 19:30

What's On

Further itinerary details in the coming months. If you are an Ashby Patron please add these dates to your diary and stay tuned! If you

18 - 21 April 2024

This lecture will be in English. The contribution illustrates the projects and new challenges of the Appia Antica Archaeological Park, an independent Institute of the Italian

24 April 2024

18:00 - 19:30

This lecture will be in Italian. Filippo Coarelli è nato a Roma il 9 Giugno 1936. Ha insegnato nelle Università di Roma, Siena, Cosenza, Perugia.

2 May 2024

18:00 - 19:30

Latest News

Latest News

The British School at Rome is delighted to announce the election to an Honorary Fellowship of Bridget Riley, CH CBE D.Litt (Oxon) Litt.D. (Cantab). One

The BSR invites applications from those interested in being considered for election as a member of the Faculty of Archaeology, History and Letters (FAHL). To

It is with much sadness that the BSR shares news of the sudden passing of Mr Peter J Smith, Ashby Patron and Honorary Fellow. Since